You know that gut-wrenching moment in a sales call when the prospect goes quiet after you mention price, and later you replay it wondering what went wrong? For years, that was me, leading a mid-market sales team, relying on CRM notes that were half-baked at best, guessing why win rates hovered at 22%. Then we brought in Gong AI, this revenue intelligence platform that records calls, emails, and meetings, then uses AI to dissect every interaction for patterns, risks, and wins. In our first quarter with it, we spotted “pricing objection” spikes early, coached reps on better handling, and bumped closes by 18%, no more flying blind. If you’re managing sales, CS, or revops, scaling team or solo closer, Gong turns conversations into your biggest data asset. It’s not magic (setup takes effort), but the insights feel like cheating. Here’s my take from rolling it out in late 2025, plus what thousands of users are saying on G2 and TrustRadius, so you can gauge if it’ll ring your gong too.

Gong kicked off in 2015 as a call recorder but evolved into a full revenue AI beast by 2025, trusted by 5,000+ companies like LinkedIn and Shopify. It captures interactions across Zoom, Teams, email, and dialers, transcribes with high accuracy, then layers AI for deal risks, coaching cues, and forecasts based on real buyer signals, not rep opinions. Core modules include Engage for outreach automation, Forecast for pipeline health, and Analytics for team trends. I loved how it flagged “multi-threading” gaps in deals, prospects talking only to one contact, and prompted reps to loop decision-makers. Adoption’s huge, with G2 crowning it #1 software multiple years running.

The Features That Turned “Hunches” Into Hard Data

From my rollout and reviewer consensus (G2 4.8/5 from 6k+, TrustRadius 8.8/10), here’s what delivers.

- Conversation Intelligence: Records/transcribes everything, spots talk ratios, objections, competitors. AI summaries and “Ask Gong” queries (“Why did we lose Q3 deals?”) pull instant answers with clips.

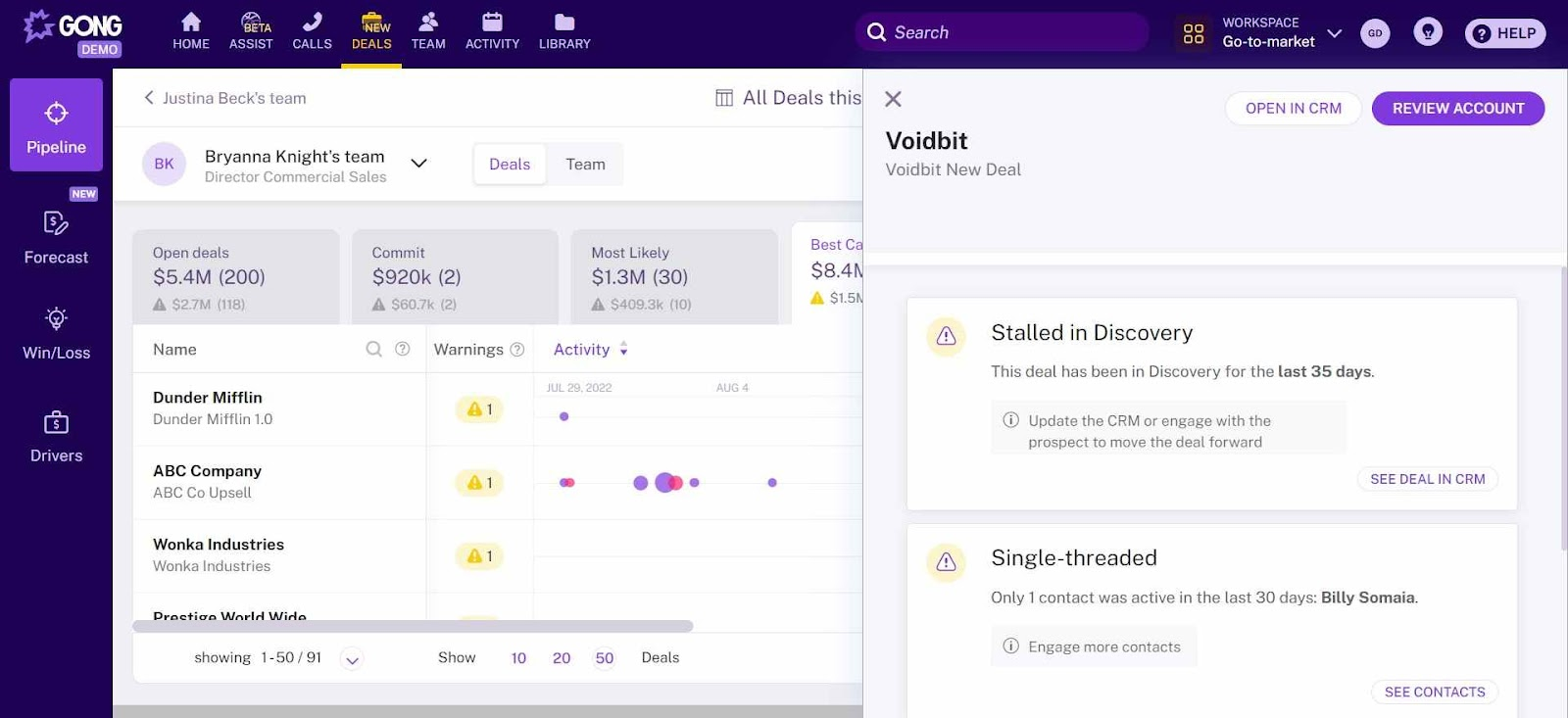

- Deal & Risk Alerts: Scores opportunities, flags stalls (low engagement, no champs). Saved us multiple six-figure slips by early warnings.

- Coaching & Scorecards: Benchmarks top reps, auto-generates feedback. Managers review calls 3x faster, per Lindy reviews.

- Forecasting Dashboard: Predicts based on interactions, not CRM guesses, 20% more accurate, users claim. Visuals track velocity, slippage.

- Integrations & Automation: Syncs Salesforce/HubSpot, Slack alerts, email drafts. Reply.io testers note seamless multi-channel capture.

Futurepedia calls it “essential for data-driven revenue,” with AI evolving fast in 2025.

The Honest Gripes (It’s Powerful, But Demands Commitment)

Gong’s gold for scale, but cons hit hard. Setup/onboarding drags (weeks for full sync), and if CRM data’s dirty, insights suffer. Transcription dips on accents/noise, search can flood results. Some SoftwareAdvice users gripe data export limits, tough switching. Mobile’s basic, support ticket-based (slow for urgents). Biggest? Cost, enterprise heft scares smaller teams. Vs. Chorus (Zoom-owned, cheaper) or Fireflies (lighter transcription), Gong wins depth but trails simplicity/price for <50 reps.

Pricing: Enterprise Muscle, Enterprise Wallet

No public tiers, sales demo required. From 2025 reports: $5k+ platform fee + ~$1,400/user/year (scales down with volume, e.g., $100k+ annual for 100 seats). Add-ons for forecast/engage push higher. ROI quick for 50+ reps via win rate lifts, but solos/midsize often pass.

Who’s Ringing the Gong (And Who Hangs Up)

This thrives for mid-large sales teams (50+ reps), revops forecasting obsessives, or CS scaling retention, tech/SaaS heavy users. If conversations drive revenue and you need coaching at scale, it’s unmatched. Skip for small teams (<20 reps), budget-conscious, or simple recording needs (Otter/Avoma cheaper).

Verdict: 8.8/10, Revenue Radar That Pays Off Big

Gong didn’t make sales easy, but it made it smarter, turning “I think” into “data shows,” with coaching that sticks. In 2025’s crowded field, it’s a leader for serious revenue orgs, docking for cost and ramp-up. Demo it, run a pilot on recent calls, query risks, watch patterns emerge. You might close Q1 stronger than ever.

What’s your sales blind spot, objections or forecasting? Spill; Gong might spotlight it.