Ever had that moment where you’re staring at a dozen spreadsheets from accounting, HR, and sales, trying to mash them into a coherent forecast, only to realize half the numbers don’t match and you’re chasing ghosts in formulas? Last quarter, that was my nightmare as a finance lead for a mid-size SaaS startup, hours lost to manual pulls, version confusion, and reports that felt like guesses. Then we piloted Aleph AI, this AI-native platform that’s like a super-smart bridge between your messy data sources and the spreadsheets you already love. Upload your ERPs, CRMs, or whatever, set up quick mappings, and it auto-syncs everything into Excel or Sheets with version history and AI smarts for variance spotting. In my first month, what used to take a full day of wrangling became a 30-minute refresh, with built-in narratives that made board prep a breeze. If you’re in FP&A, finance ops, or running numbers for a growing biz, solo analyst or team of 10, Aleph could be the quiet upgrade that frees you for strategy over spreadsheets. But it’s not cheap, and the setup might test your patience. Here’s my take from hands-on testing and sifting through 2025 user buzz, so you can decide if it’ll click for your chaos.

Aleph hit the scene in 2020, founded by Albert Gozzi (ex-CFO and Bain consultant) who built the MVP out of sheer frustration with clunky tools. By late 2025, they’ve raised over $45M (including a $29M Series B in September), powering finance teams at spots like Zapier, Turo, and Envoy. The core pitch? It’s a cloud-based hub that pulls disparate data (accounting, HRIS, billing) into a single source, then lets you model, forecast, and report right in Excel/Google Sheets via bi-directional add-ins. No ditching your favorite tools, just supercharging them with AI for automation, like instant variance analysis or narrative reports. I synced our QuickBooks and HubSpot in under 10 minutes, and suddenly my monthly close had audit trails and real-time refreshes. It’s not a full ERP replacement, more a FP&A layer that embraces spreadsheets while adding governance and insights.

The Features That Actually Delivered (And Quick Wins to Try)

From my pilots and reviewer echoes, here’s what packs punch, no fluff, just the bits that moved the needle.

- Data Consolidation Magic: Integrates 150+ systems (ERPs like NetSuite, CRMs like Salesforce), maps fields automatically, schedules pulls. I linked our fragmented sources, and variance tracking flagged a $5K mismatch I’d have missed.

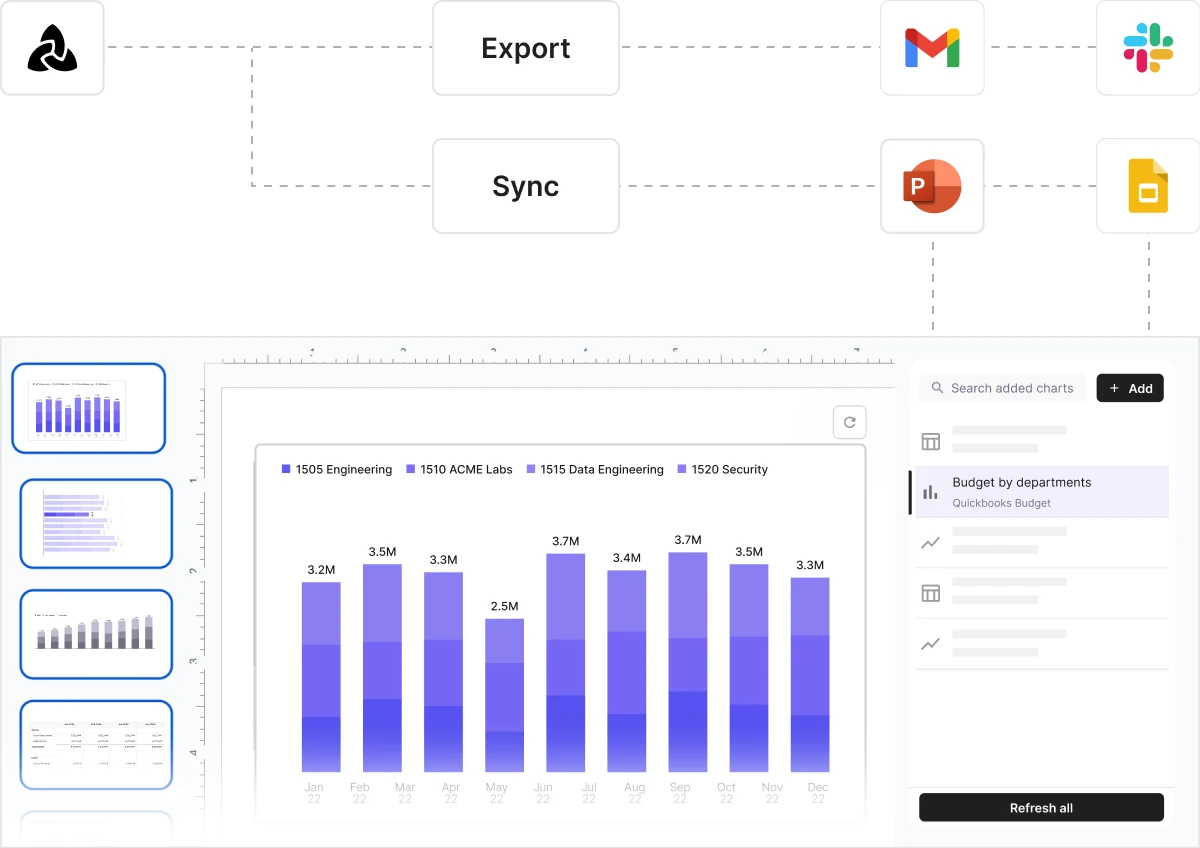

- Spreadsheet Superpowers: Bi-directional add-ins sync data live, edit in Excel, it updates the central DB. Version history lets you rollback like Git for finance, killer for “what changed since last board?”

- AI-Driven Insights: Auto-generates narratives, variance reports, headcount plans. Ask in natural language (“Why did G&A spike?”), get breakdowns with charts. Users rave about this slashing manual analysis by 50-70%.

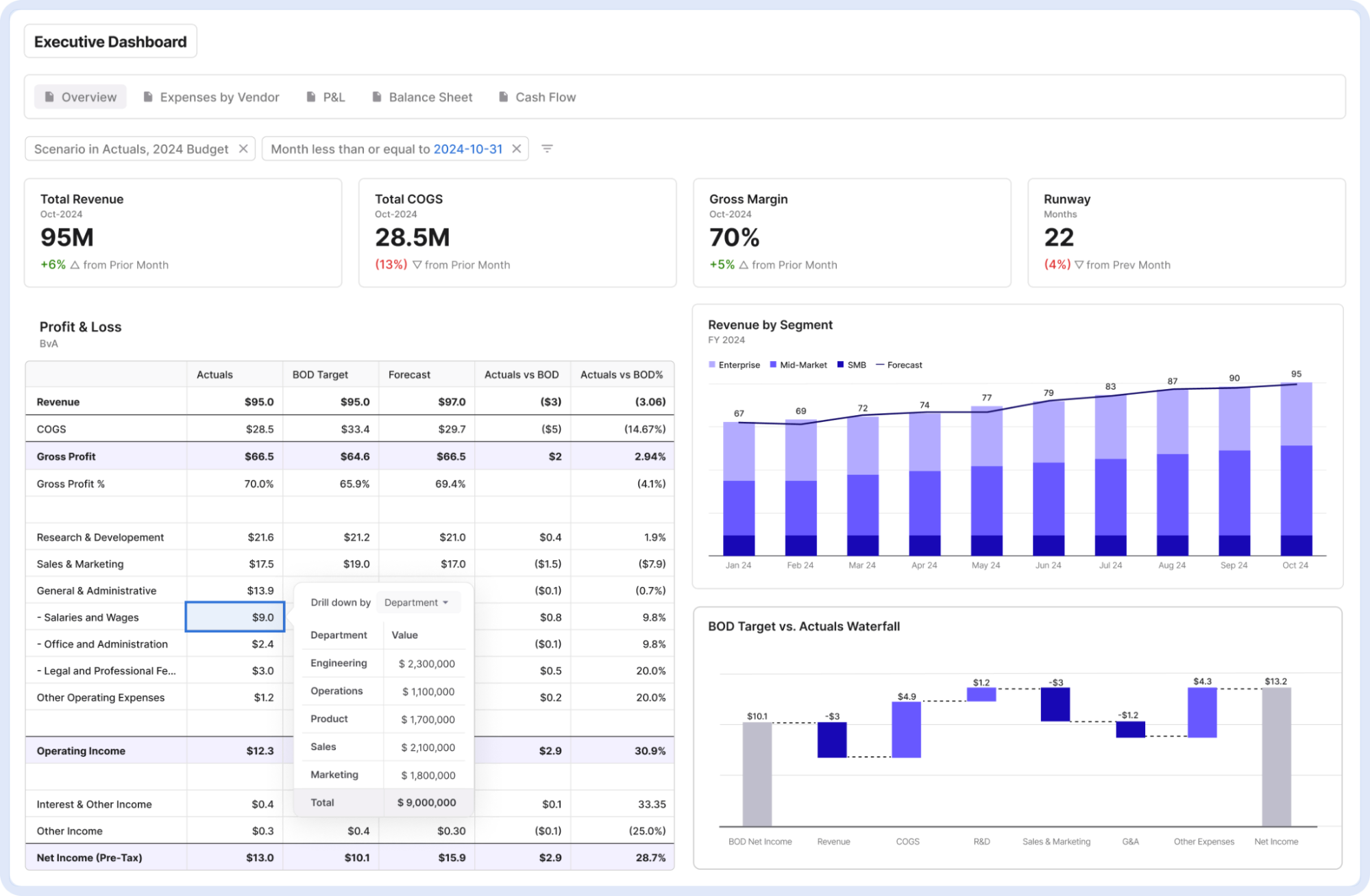

- Dashboards & Reporting: Custom visuals for metrics, investor packs, or closings, audit-ready in seconds. Role-based access keeps sensitive stuff locked.

- Governance & Collaboration: Audit trails, permissions, no-code workflows. Teams at BigID say it turned finance from “gatekeepers” to “insight partners.”

G2 (scattered but positive 2025 feedback) and TrustRadius users highlight ease: “Up in a week, no IT drama,” with one CFO crediting it for flat headcount despite growth.

The Real Talk: Wins Shine, But Bumps Bite

Aleph nails the basics with flair, TechCrunch called it a “market gap filler” for spreadsheet lovers, and customers like Postscript echo time savings (tasks from days to hours). Quick onboarding, fluid UI, and AI that feels “modern” stand out, especially for SaaS/tech firms. Data integrity’s a 5/5 win, with compliance perks like trails.

But oof, the cons stack up. Steep learning curve for non-techies, UI’s “inefficient” without filters, per Drivetrain’s comps. Limited integrations (150+ lags behind 800+ rivals), performance slows on massive sets, and customization’s restricted (no deep UI tweaks). Support’s spotty for newbies, and search lacks punch. Some switch to Drivetrain for unlimited modeling or Mosaic for BI dashboards. If your data’s clean and team’s spreadsheet-savvy, it’s gold; otherwise, prep for tweaks.

Pricing: Custom Quotes, Mid-Market Sweet Spot

No public tiers, demo required, but hints peg it as $$ (mid-range). Best for small/mid-market (under 500 employees), with quick ROI from automation. Competitors like Datarails or Vena match for Excel fans, but Aleph’s AI edge justifies if variance/narratives are your jam.

Who’s Crushing It With Aleph (And Who Looks Elsewhere)

This one’s for FP&A teams at growth-stage companies (tech, SaaS, services), CFOs automating closes, analysts building forecasts without IT. If spreadsheets rule your world and data silos kill you, dive in. Solos/light users? Overkill, try free add-ins. Enterprise giants? Might need Planful’s consolidation muscle.

Verdict: 9.1/10, Spreadsheet Savior With Growing Pains

Aleph won’t reinvent finance, but it’ll drag your spreadsheets into 2025 with AI smarts that make data feel alive, not locked away. For me, it unlocked hours for strategy, turning “report drudge” into “insight flow.” The curve and limits dock points, but for mid-market hustlers? Worth the demo. Upload a sample dataset, map a source, watch it sync, feel the shift. You might just kiss manual mismatches goodbye.

What’s your FP&A headache, data pulls or reports? Spill; Aleph might reconcile it.